Estate planning involves preparing for the unforeseen and one crucial aspect is trust funding. While the process may seem complex, our team at the Law Office of Cameron H.P. White, P.A. is here to guide you through it. As an Estate Planning Lawyer in Florida, I recognize the importance of transparency and accessibility. Let’s explore the intricacies of funding a trust without delving into legal jargon.

Transferring Assets with Purpose

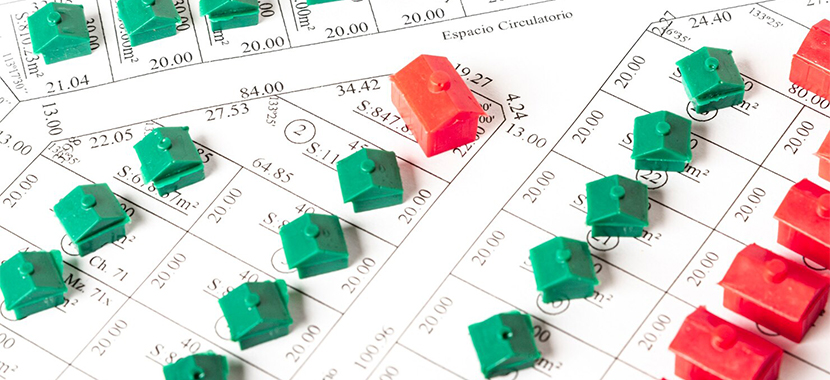

Funding a trust is a fundamental step in estate planning, involving the strategic transfer of assets into the trust’s ownership. The objective is to ensure that these assets are managed and distributed in line with your specific wishes, providing a structured and efficient way to handle your estate after your passing.

Understanding Asset Variety in Trusts

The complexity of trust funding stems from the diverse range of assets that can be included. This encompasses tangible assets like real estate, liquid assets such as bank accounts, and intangible assets like investments. The key is to identify and categorize each asset appropriately within the trust, allowing for comprehensive and organized estate management.

Real Estate in Trust Funding

Real estate is a crucial aspect of trust funding. The process includes transferring the legal ownership of properties into the trust. This guarantees that the trust has control over these assets, facilitating more seamless management and distribution. In the context of Florida law, nuances may exist in the procedures for transferring real estate into a trust, emphasizing the importance of addressing these intricacies with care.

Bank Accounts and Investments

Beyond real estate, financial assets like bank accounts and investments are integral to trust funding. This includes savings accounts, certificates of deposit, stocks, and other investment instruments. The challenge lies in aligning these diverse financial holdings with the trust, creating a seamless integration that facilitates effective management and distribution.

Key Considerations in the Trust Funding Process

Trust funding involves adhering to legal formalities associated with each type of asset.

This may include executing deeds for real estate, updating account registrations for bank accounts, and transferring ownership for investments.

- Tax Implications: The funding process may have tax implications, and understanding these implications is vital. Properly structuring the funding can potentially minimize tax burdens on the estate and its beneficiaries.

- Documentation: Thorough documentation is critical in trust funding. Clear records of asset transfers, legal documents, and updated account information ensure a transparent and efficient process.

Understanding Revocable and Irrevocable Trusts

Revocable and irrevocable trusts are common choices for estate planning. Revocable trusts offer flexibility, allowing changes during your lifetime, while irrevocable trusts provide added asset protection. In Florida, understanding the implications of each trust type is vital for making informed decisions.

Challenges and Considerations

Funding a trust comes with challenges, and anticipating them is key to a successful estate plan. Whether it’s addressing tax implications, ensuring proper documentation, or managing changing circumstances, our team is dedicated to guiding you through potential hurdles.

Tips for Effective Trust Funding

To facilitate a straightforward trust funding process, consider organizing a comprehensive list of your assets, understanding the roles of trustees and beneficiaries, and regularly reviewing and updating your trust. These practical tips empower you to take control of your estate planning journey.

Why Trust Funding Matters

Summarizing the key points, trust funding is a crucial step in ensuring your assets are protected and distributed as per your wishes. By avoiding common pitfalls and being proactive in your estate planning, you provide your loved ones with a secure future.

Connect with the Law Office of Cameron H.P. White, P.A.

When going through the complexities of trust funding, the Law Office of Cameron H.P. White, P.A. is your trusted partner. Our team has experience in demystifying the legal processes, making them accessible to our clients. Contact us today at 407-792-6011 or online to discuss your estate planning needs. Let us guide you toward a secure and well-planned future for you and your loved ones.